Press Kit

Hey, thanks for stopping by, hopefully here you can find everything you need to know about The FIRE App.

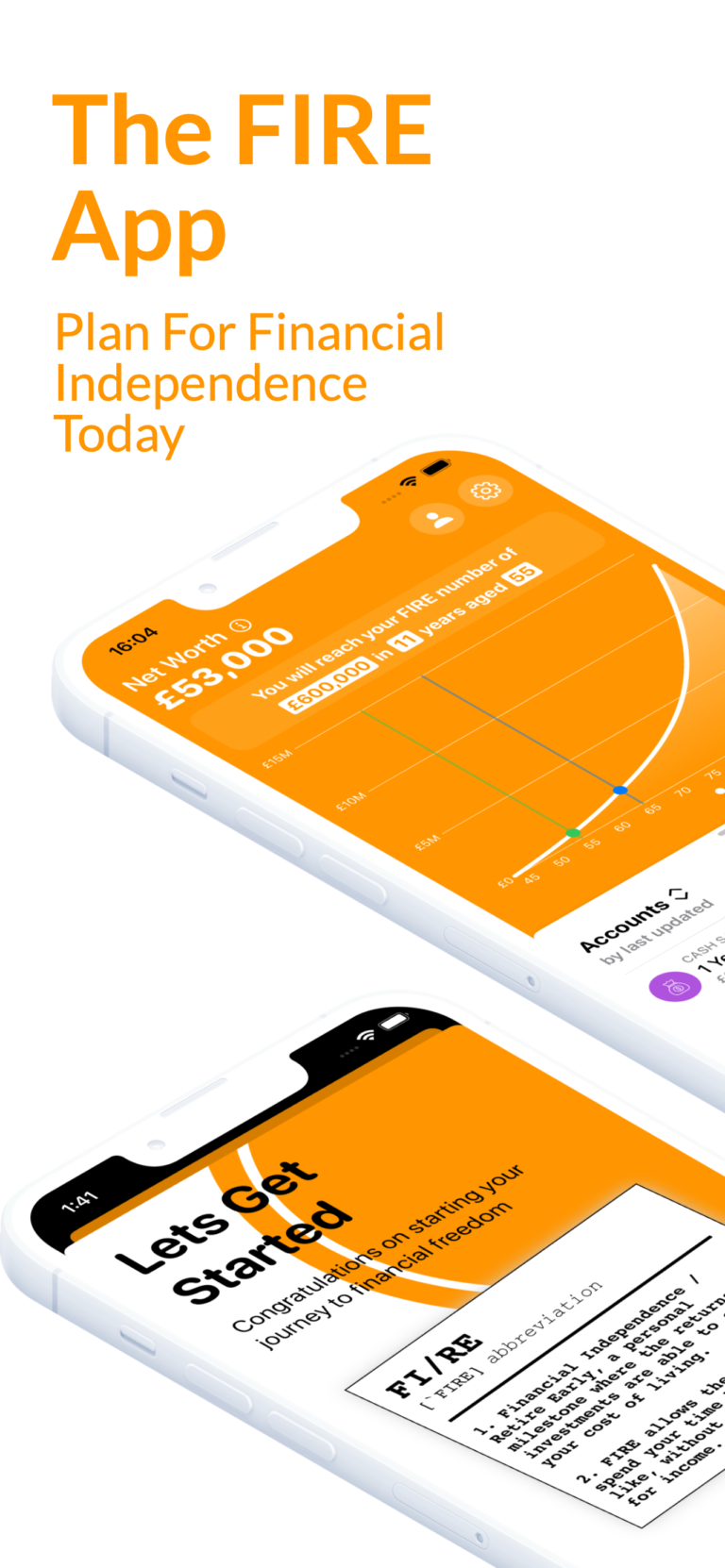

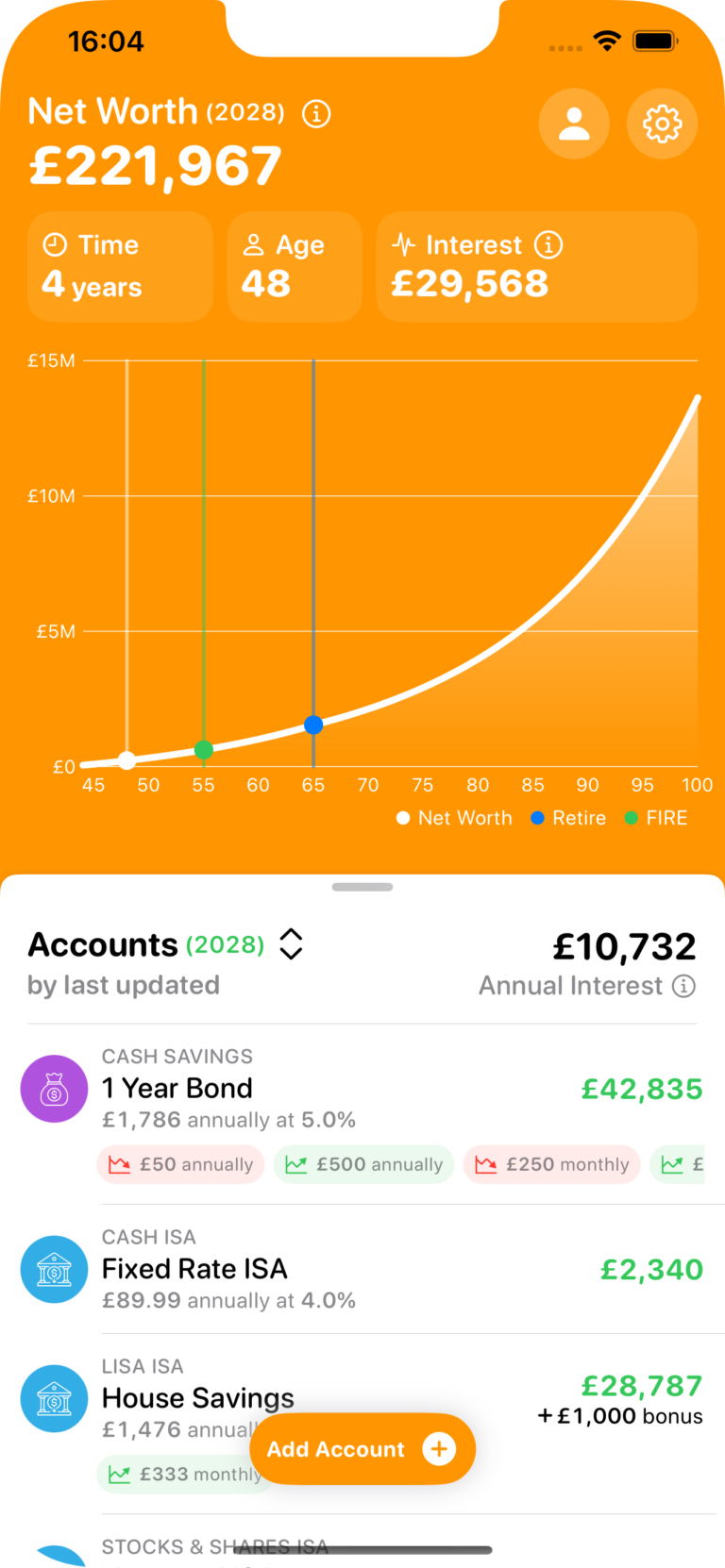

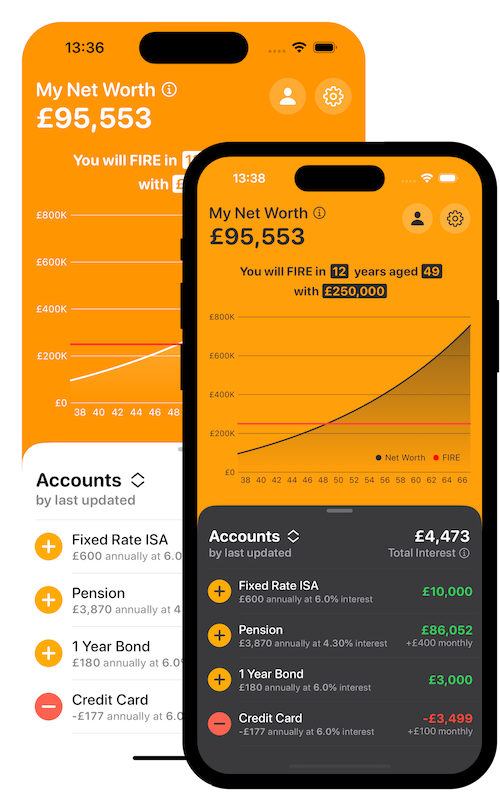

We built this app to help people visualise their financial future based on where they are today. The world is changing, costs are rising and we believe in providing better tools to help everyone prepare for the future.

Our ultimate goal is to make becoming financially free a reality, by showing that with some careful planning it may even be possible to retire early and live life on your own terms.

Where can you get it?

The FIRE App is available for iOS on the App Store in the UK. Download the app by clicking the icon below from an iOS device.

Frequently Asked Questions

Why FIRE?

FIRE stands for Financial Independence/Retire Early which is a movement that has gained popularity in recent years on Reddit and refers to a milestone where the returns on investments are able to cover ones cost of living. Once this milestone is reached, it should be possible to live off the returns from the investments indefinitely allowing the freedom to spend your time however you like, without the need to work for a living. Today this community has grown to over 2 million users.

How does the app help me FIRE?

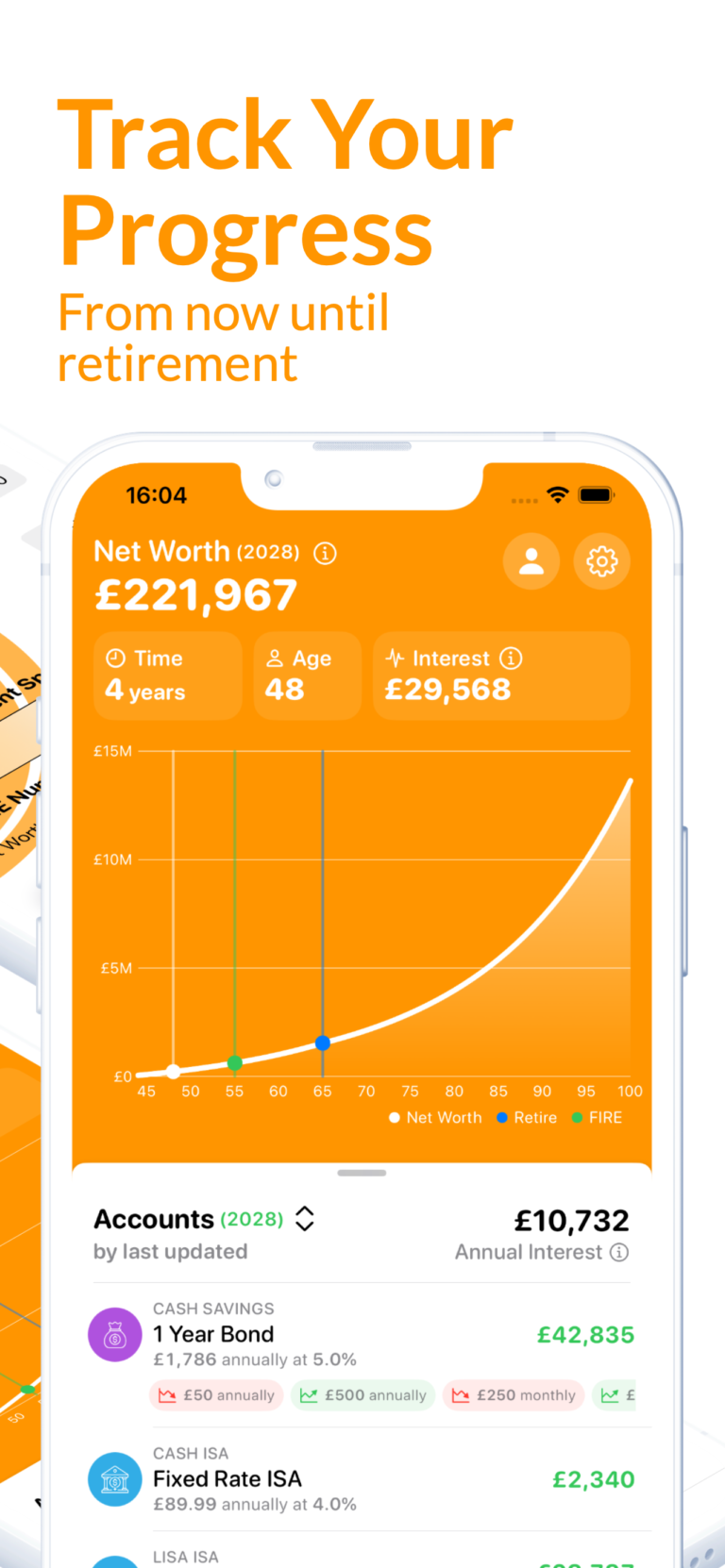

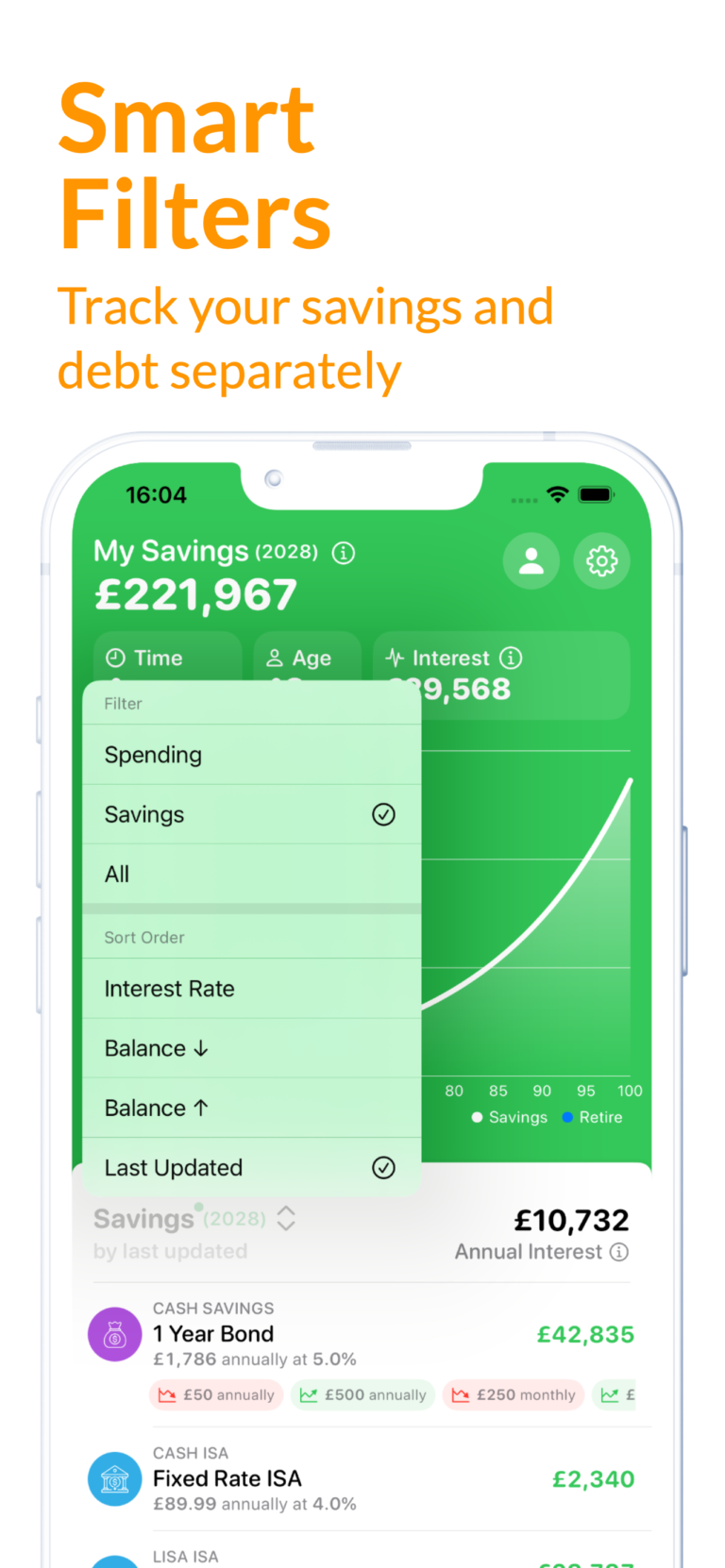

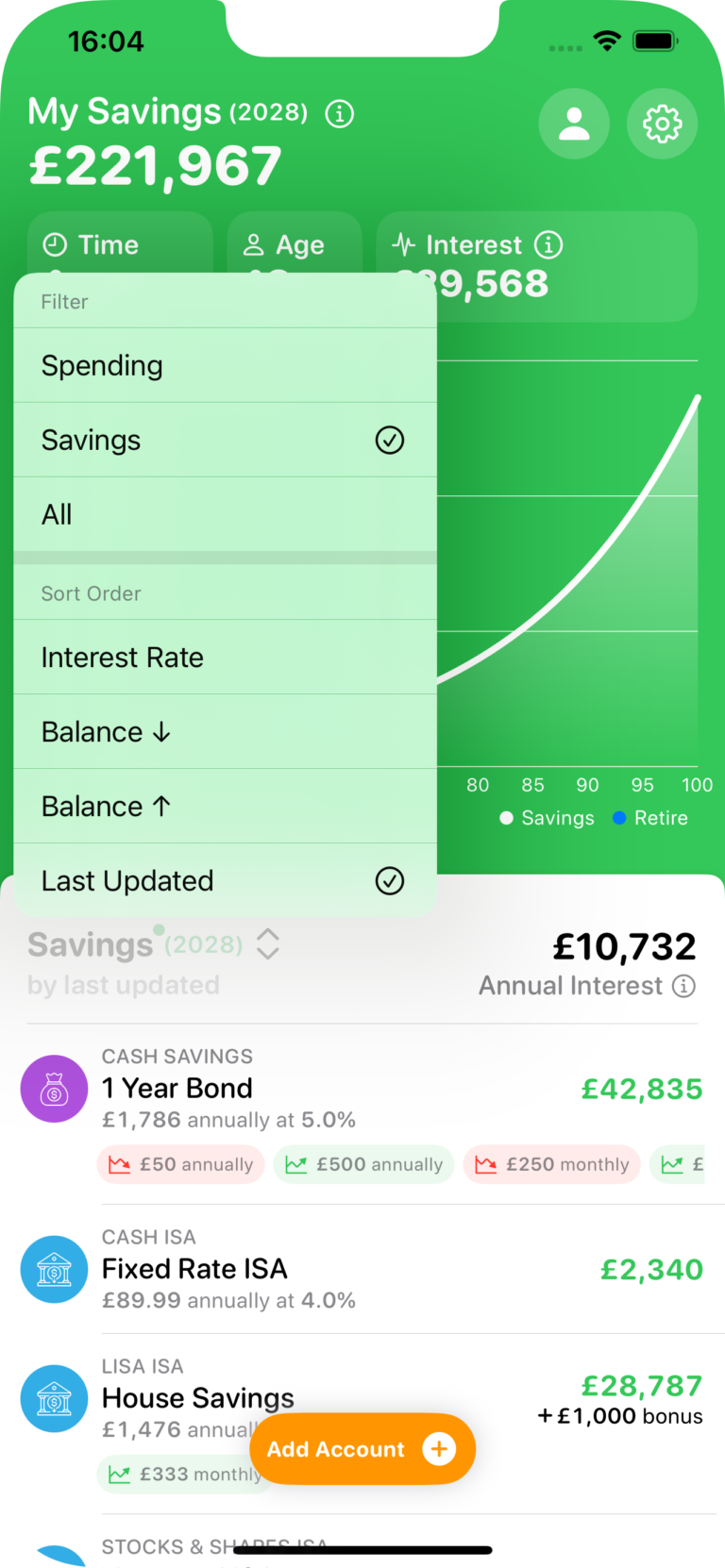

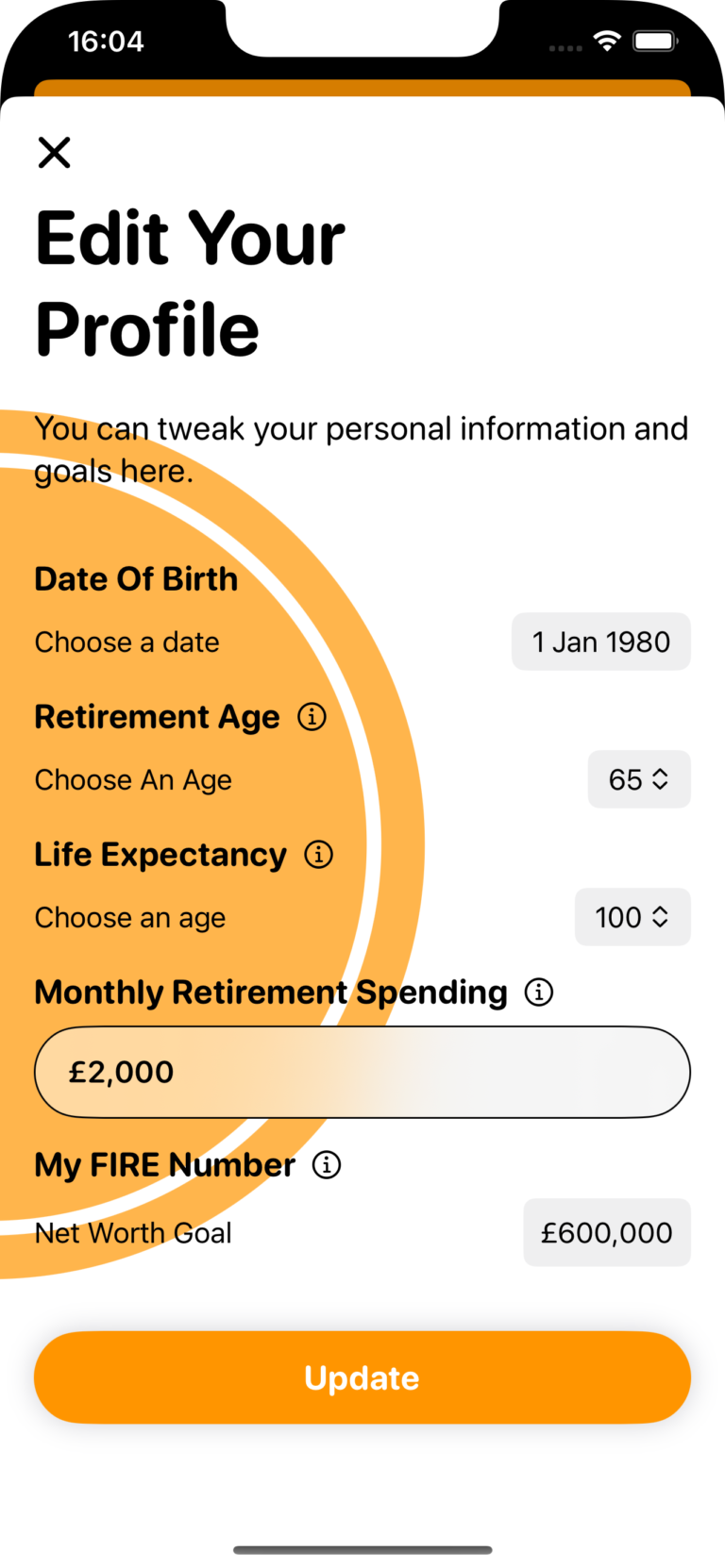

Sometimes half the battle is knowing what you have and being able to visualise your current financial position in a single place. The FIRE app helps by keeping track of all your finances, savings, investments and debt and calculates your current “net worth” along with how you’re tracking towards retirement. This information can be used to make better financial decisions, helping you stay on track towards your retirement goals.

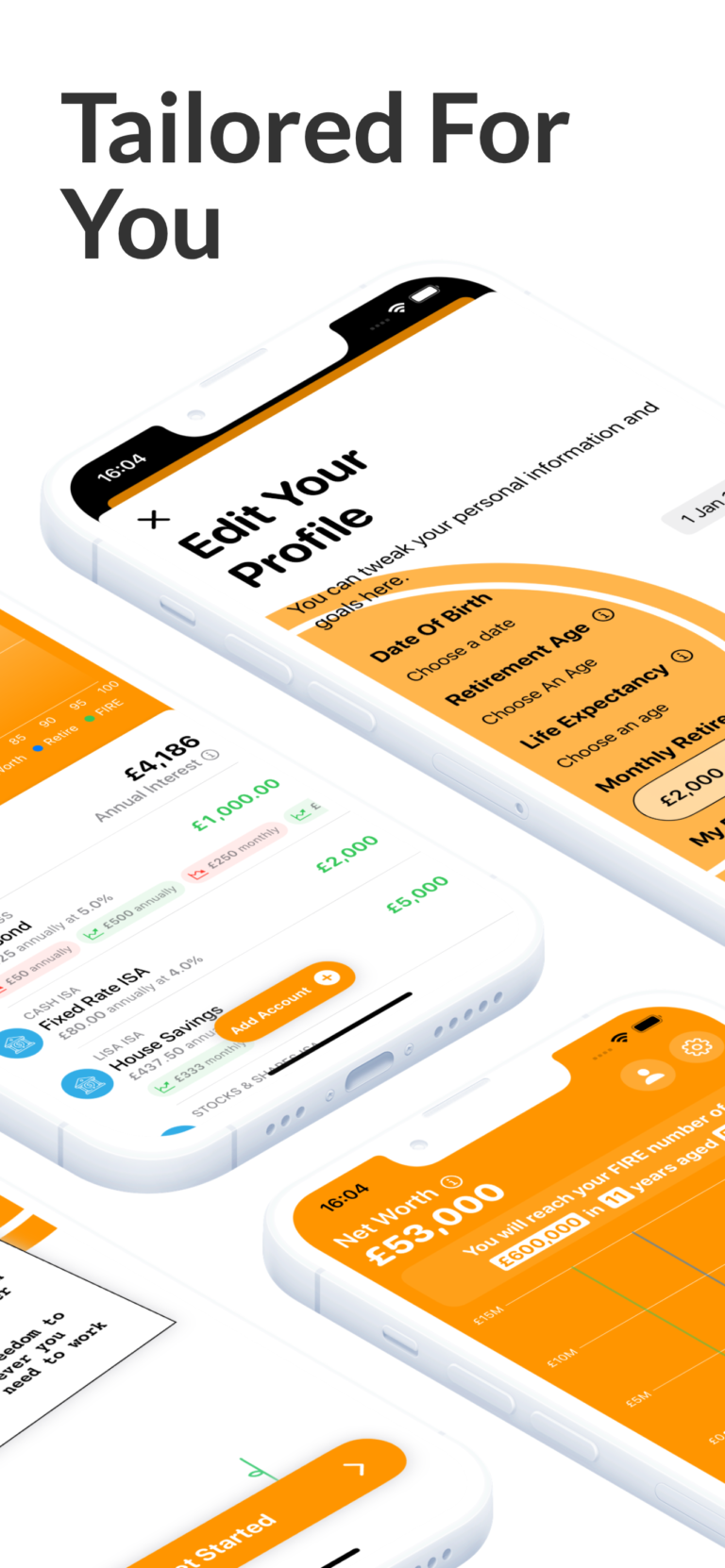

Can I update my information over time?

Of course. Life changes and so can your financial situation. The Fire App allows to add, remove or edit your account information at any time and all figures will be automatically re-calculated.

How accurate are the projections?

The FIRE App uses standard, proven calculations for projecting compound interest along with sophisticated algorithms for taking into account inflation and recurring payments or withdrawals based on your financial inputs. While they’re informative, please remember that projections are estimates and subject to market fluctuations.